“Please note that for foreign investment, PMV can only be owned by a business entity or institution in the form of a limited liability company, with a maximum of 85% (eighty five percent) foreign ownership shares in a PMV.”

Venture Capital Company in Indonesia:

Indonesia is known as one of Asia’s most attractive emerging markets and investment target. Indonesian demographic and geographic condition has attracted many foreign investors to execute their business and investment plan in various sectors.

Venture Capital Business as one of direct investment instrument also has grown dramatically over this pass few years, therefore trough this article we would like to share a brief summary of what and how to start a Venture Capital Business from Indonesian legal aspect.

Before we go further with our discussion, let’s see first on the definition of Venture Capital Business from Indonesian prevailing law and regulation perspective.

“Venture Capital Business is a business financing through capital participation and/or financial scheme with certain period in order to develop capital venture partner or debtor business.”

Venture Capital Company (“PMV”), is a business entity conducting Venture Capital Business activities, managing venture funds, fee-based service activities, and other activities with the approval of the Financial Services Authority. PMV in Indonesia must be established in the form of a business entity:

a.limited liability company (PT);

b.cooperative; or

c.limited partnership.

Capital and Foreign Ownership Aspects in Venture Capital Companies in Indonesia:

PMV must meet the capital requirements at the time of establishment as follows:

a.limited liability company, has Paid-up Capital at least Rp. 50,000,000,000.00 (fifty billion rupiah);

b.cooperative legal entity, has Paid-in Capital of at least Rp. 25,000,000,000.00 (twenty-five billion rupiahs); or

c.a limited partnership company, has Paid-in Capital at least Rp. 25,000,000,000.00 (twenty-five billion rupiahs).

Capital as referred to above must be paid in cash and in full in the form of time deposits on behalf of PMV at one of the commercial banks or sharia commercial banks in Indonesia.

Please note that for foreign investment, PMV can only be owned by a business entity or institution in the form of a limited liability company, and with a maximum of 85% (eighty five percent) foreign ownership shares in a PMV.

Procedure for Establishing Venture Capital Companies in Indonesia:

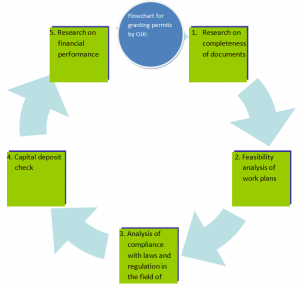

Every party who conducts PMV business activities must obtain a business license from the Financial Services Authority (“OJK”). To obtain the business license, the Board of Directors must apply to OJK.

OJK in order to give approval or rejection of the application for a business license as referred to within a maximum period of 30 (thirty) working days after the application for a business license are completely received.

PMV that has obtained a business license from OJK must conduct business activities no later than 6 (six) months after the issuance. PMV must submit a report on the implementation of business activities to OJK no later than 10 (ten) working days from the date of commencement of business activities.

Gaffar & Co.

Gaffar & Co. is an Indonesian Law Firm that Focus on Commercial Law Area.

For further queries and information, contact us:

+62-21 5080 6536| info@gaffarcolaw.com | www.gaffarcolaw.com

Author: Belle Risca Junia / Arif Gaffar